Seller Note solutions from Unsecured Funding Source help business brokers and sellers accelerate wealth creation.

- Complete our 60-second seller note application

- We’ll contact you to follow-up

- We’ll complete a brief no cost or obligation Seller Note evaluation

Are you carrying a seller note on a business you sold or do you plan to use one as part of an upcoming transaction? UFS can help guide you in the right direction with our new SellerCashOut™ and SellerBridge™ programs, designed specifically for business brokers and sellers!

Why sell your note?

You may have put a note in place in order to facilitate the sale of your business, but your needs may have changed and now you’d rather have a lump sum of cash. That’s exactly what SellerCashOut™ is designed to help you accomplish. Reasons you may want to cash out now may include:

- Immediate need for lump sum of money

- Desire to diversify assets

- Ability to reinvest the money in higher yielding assets

- Want to pay off high interest debt

- Need cash in a new business venture

- Ready to cut ties with the buyer and the old business altogether

- Unexpected medical expenses

SellerCashOut™ is designed to help you quite literally “cash out” your note by turning a promissory note into a lump sum of cash. We help you evaluate your existing note(s) and the business in question, bring these notes to specialized investors, negotiate offers and, if you accept an offer, facilitate the transaction on your behalf.

How do I know if I can sell my note?

Our team will have more success finding an investor and getting an offer as close as possible to the full face value of your note if the following criteria are met:

- The buyer has a good credit score

- The buyer put at least 20% down on the business

- The note has a personal guarantee

- There is already a UCC filing on the business, or one can be filed

- The buyer has been paying the note on time for at least 3 months post-closing

- The interest rate and terms are good

- You have good record-keeping and documentation

- The business model and financials are solid

If you’re unsure of whether your note will be appealing to investors, don’t worry – contact one of our Advisors for a free consultation and initial evaluation.

What is the SellerCashOut™ process?

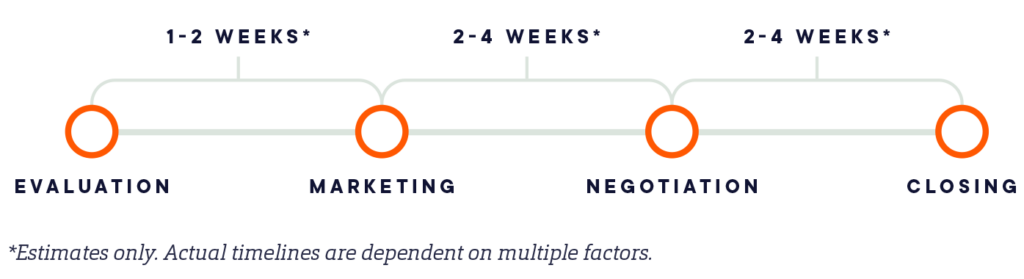

SellerCashOut™ involves 4 stages: Evaluation, Marketing, Negotiation and Closing – where you walk away with cash in hand!

Services Provided

- Review of Note

- Buyer evaluation

- Business evaluation

- Approval to sell or contingent approval, subject to note amendments

- Seller signs Broker Agreement to move forward

Pricing

- Flat fee (refunded at closing)

Services Provided

- Packaging of note for investors

- Marketing to qualified (individual and institutional) investors

- Intermediary between buyer and seller: answering investor questions and providing additional info as requested

Pricing

- Included

Services Provided

- Receiving offer(s) and presenting to seller

- Negotiating with buyer

- Agreeing to a final buy-out terms and price

Pricing

- Included

Services Provided

- Assistance with sale documentation and escrow

- Transfer of ownership to new note holder

- Facilitation of servicing transfer (if applicable)

- Facilitation of closing and payment to seller

Pricing

- Success fee that is a % of sale price, negotiated on a case-by-case basis

What if I’m considering a Seller Note?

Make sure you structure your note with the end in mind. With SellerBridge™ we can help you structure your seller note to increase your chances of a full buyout in the near future. We will work with you, your broker (if applicable) and the buyer prior to closing to help make sure you’re setting yourself up for a successful SellerCashOut™

For a flat fee (payable at closing) we handle the closing package, servicing of the note and — when you’re ready to sell — the marketing / sale of your note to qualified investors. At that point, we help you with contracts, escrow and transfer of the note to the new owner. And our success fee means we only get paid when you get the cash in hand!